To see how our expertise can help you, let’s talk

Discuss your unique business challenges and get technology recommendations.

Maximus is a global payment infrastructure and digital enablement company, offering a wide range of ecosystem solutions in the Payments, Reconciliation, Remote Monitoring and Self-Service domains. The Company’s offerings cater to banks, fintech companies, aggregators, transit, retail, and other customer service organisations.

Its customer footprint spans 10 countries.

The broad product lines of the Company encompass

(i) Payment Infrastructure Services (card and digital/real-time payment rails)

(ii) Agency Banking & Financial Inclusion Suite

(iii) Self Service Solutions (Kiosks, Digital Banking Units, etc.)

(iv) Remote Management Stack

(v) Reconciliation & Dispute Management Platform

Embedded with the core application stacks are Fraud Risk Management System, Aadhaar-based Authentication & Face Recognition Systems, Mobile Apps, Internet Banking and Web Services.

The Company’s USP is that it owns IPs of all its products, having developed them inhouse and getting them certified.

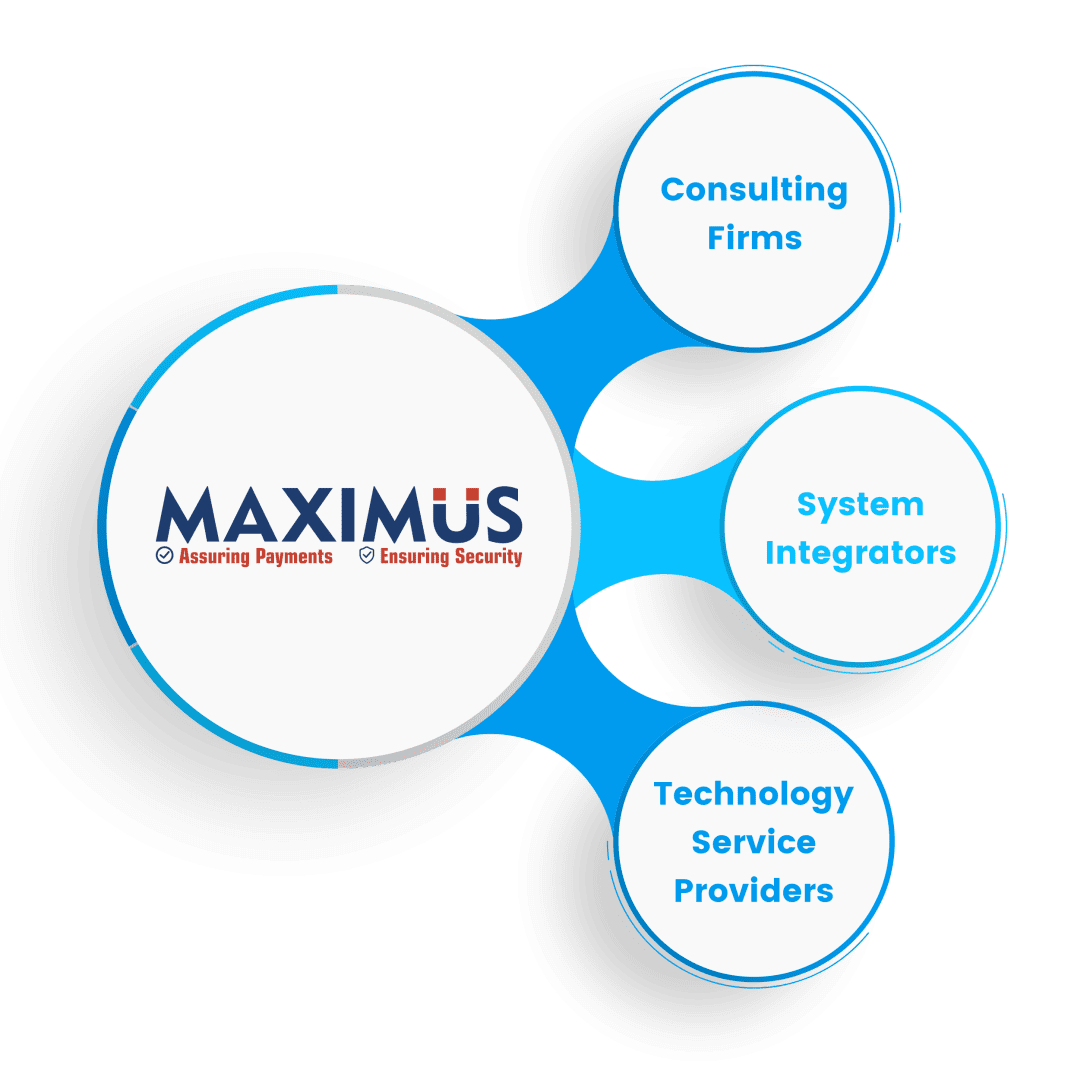

Maximus performs varied roles; depending on the specific customer requirement, it acts as a business re-engineering consultant, system integrator, technology services provider and program manager. The Company is known for high quality project delivery, committed customer centricity and exceptional technical support.

To be the best global technology-enabled service provider delighting customers with superlative services and innovative solutions, encompassing every delivery channel, payment method and customer touchpoint.

To create and sustain a frictionless, end-to-end transaction ecosystem that benefits business organizations and their customers, by leveraging current and evolving technologies.

Banks

Fintechs

Toll Plazas

Partners

Agents

ATMs Monitored (Daily)

Kiosks Managed

As we strive to be the best global technology-enabled service provider, we are set to take technology to where it has never been before. We aim to create and sustain a frictionless, end-to-end transaction ecosystem to benefit businesses and their customers, by leveraging current and evolving technologies.

Spanning more than 17 years, a dynamic journey that set our footprints in 10 countries.

Card Payments

Digital Payments

Reconciliation

Toll Plazas

Discuss your unique business challenges and get technology recommendations.