To see how our expertise can help you, let’s talk

Discuss your unique business challenges and get technology recommendations.

24/12/2024

In recent times, India has joined the digital payment space outpacing its partners and opponents. In 2022, 46 per cent of the global transactions in real time digital space took place in India and its position in digital market world rankings is now second only to China. Such a trend toward cashless existence may see India to lead the financial world in the future.

The National Payments Corporation of India (NPCI) developed the Unified Payments Interface (UPI) in 2016. The system powers multiple bank accounts into a single mobile application, so that users can transfer money via their phone on an app. This can be done when the app is used by users or merchants, or via scanning QR codes.

Widely implemented in India, UPI has over 300 million active users; and it facilitated 117.7 billion transactions in 2023, accounting for around 183 trillion Indian Rupees. This digital system is well suited for the country and is growing at a rapid pace. The payment platform EBANX has stated that India was the country with the highest growing number of digital buyers since 2017, with projections expecting 400 million by 2027.

According to EBANX’s latest report Beyond Borders 2024, new consumers in India are leading the world, adding 34 million people in 2024, bringing it to one third of the global consumer class. Recently the Brazilian platform announced a strategic alliance with YES BANK of India to better connect Indian users to global products and digital services through UPI, further enhancing the reach of this local Indian payment method.

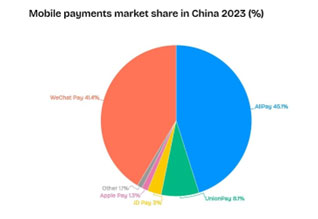

Functionally, UPI is very similar to the Chinese digital payment systems WeChat Pay and Alipay. But UPI has one key difference. Unlike WeChat Pay and Alipay, which are owned by private tech companies (though the Chinese government owns one per cent share in each company), UPI is wholly owned by the Indian government.

From its inception, UPI has been designed to integrate with banks and government systems. And its Chinese counterparts have often struggled with or campaigned outright against government attempts to control them. For example, it has been difficult for international users of these systems to use them without a Chinese bank account, and only recently these companies have started integrating foreign bank accounts on its platforms.

UPI is far more accessible to non-Indians as compared to its Chinese counterparts like Wechat and Alipay. Users can easily recharge their digital wallets with UPI, and pay Indian businesses, the facility that Chinese apps did not even have till recently.

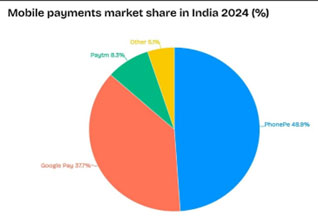

Source: NCPI

Source: NCPI Source: iResearch

Source: iResearchUPI was built up from the ground by government interests, as compared to Chinese payment systems like Wechat and Alipay. That is why the use of UPI as a tool for economic expansion by India has been more widespread. In 2020, the National Payments Corporation of India and the Reserve Bank of India (RBI) made a strong move to internationalise UPI, forming NPCI International Payments (NIPL). Countries like Asia, Africa and Middle East have shown interest in replicating this model in their own countries.

NIPL has been stretching across continents expanding to Malaysia, Singapore, Australia, Canada, United Kingdom, Hong Kong, Oman, Qatar, Saudi Arabia, UAE and the United States. Countries such as France have also begun to accept UPI QR codes for tourists, which is a sign of its global expansion and growth.

As the world moves towards a cashless society, more money will flow through these payment systems. Today, India firmly occupies the role of global leader in online digital payments. It has both the technology and political will to globally expand its reach and lead the digital domain.

Discuss your unique business challenges and get technology recommendations.